Source: Laura He published on South China Morning Post

Monday 21st August, 2017

A man eats noodles served on a high-speed train from Guangzhou to Beijing. China’s demand for instant noodles has dropped 17 per cent over the past four years. Photo: Simon Song

China’s Growing Middle Class Lose Appetite for Instant Noodles, Preferring Healthier Meals Ordered Online

Just as Americans are cutting back on soda drinking, China’s appetite for instant noodles is shrinking sharply, as a growing middle class pursue a healthier diet, while the rise of food delivery smartphone apps gives consumers access to quick, easy and inexpensive meals with higher quality.

In the US, soda consumption has plunged to a 31-year low, as people cut back on sugary beverages and drink more bottled water, a recent private survey showed. That appears to be bad news for companies like Coca-Cola and PepsiCo, which have been striving to diversify beyond soda. In July, Coca-Cola replaced Coke Zero in the US with Coke Zero Sugar, hoping to hold on to consumers.

In China, a similar trend is seen.

As the personal disposable income of Chinese consumers has more than doubled in the past decade, consumption for instant noodles, or “convenient noodles” in Chinese, has plunged.

China’s demand for instant noodles declined 17 per cent to 38.5 billion servings in 2016, from 46.2 billion servings in 2013, according to statistics from the World Instant Noodles Association.

Uni-President, which supplies more than a fifth of China’s instant noodles and tea drinks, recently reported a 27 per cent decline in net profit for the first half.

Revenues have decreased for a fourth straight year since 2013, down 7 per cent in the first six months.

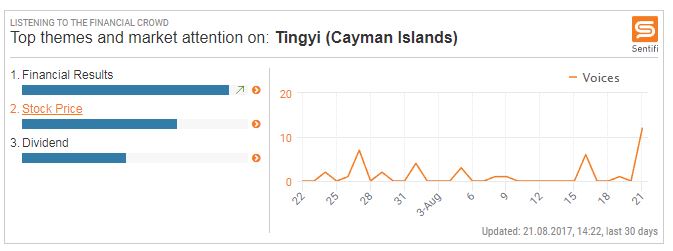

Its biggest rival, Tingyi, is no better off. The company, which accounts for 50 per cent of China’s instant noodles and tea drinks market, suffered a 30 per cent drop in profit for both 2015 and 2016. In the first quarter of this year, Tingyi’s net profit barely grew from the same period last year. From 2013 to 2016, the company laid off 15,400 employees.

“The instant noodle market is shrinking, as the new generation of consumers prefers healthier, finer products,” said Xiao Chan, an analyst for Orient Securities.

“Unlike the elder generation, millennials and white-collar workers, who have become the core consumers of food and beverages, try to eat less sugar, fat, and processed foods.”

Consequently, inexpensive instant noodles and deep-fried foods, once the favourites of the generations that were born and raised in the age of widespread hunger in China, are gradually falling out of favour.

Instead, bottled water, dairy products, and whole foods are catching on.

The rise of food delivery smartphone apps gives consumers access to quick, easy and inexpensive meals of higher quality. Photo: Nora Tam

Moreover, the growing tech-savvy middle class has fuelled the rapid growth in online food delivery industry, with more urban consumers turning to their smartphones to order door-to-door delivered, higher quality meals with heavy discounting.

“10 years ago, we loved the instant noodle because it’s convenient. But 10 years on, it has faded out from our life because we can order quick, easy, and higher quality meals online, which are not expensive and also convenient,” said Liu Zhangming, an analyst for TF Securities.

China’s food delivery industry reached a market size of 152.4 billion yuan (US$22.8 billion) in 2016, up 232 per cent from 2015, according to China e-Commerce Research Centre, a private e-commerce research firm.

By the end of June this year, the number of users on food delivery apps reached 295 million, up 41.6 per cent from the same period a year earlier.

“During the past few years, we’ve seen the decline in sales of instant noodles, which coincided with a rise in the consumption of healthy food and the explosive growth in online food delivery business. Behind all these is the consumption upgrade,” Liu said.

Another key reason behind the decline of instant noodles sales may be the slowing economy, which is responsible for a shrinking labour force of low-paid migrant workers from countryside to city and inexpensive products catered for them, he added.

Workers eat street food at a stall outside a construction site in Beijing. Migrant workers are a key consumer group for instant noodles. Photo: Reuters

“Migrant workers are a key consumer group for instant noodles,” Liu said.

Government data showed the growth in migrant workers searching jobs out of home has decelerated, from 5.2 per cent in 2010 to 0.3 per cent in 2016, as jobs in manufacturing have dried up amid economic slowdown.

Bain & Company research in 2016 said the migration of manufacturing jobs to lower-wage countries, a shrinking force of working age population, and the increase in the number of low-income retirees have caused a slowdown in the sales of inexpensive products, including cheap beer and instant noodles.

Earlier this month, Uni-President announced the company would gradually exit the low-priced instant noodles market and put more focus on promoting its “high-end” instant-noodle products, such as Expert of Soup and Man Han Feast series.

“This is in line with the consumption upgrade in mainland China,” said Alex Lo, president of Uni-President Enterprises, at the firm’s results briefing.